Financial Management Software is the cornerstone of nurturing and preserving client relationships shaping successful business interactions. Salesforce Financial Services Cloud (FSC) emerges as an elite and tailored platform meticulously designed to cater to the distinctive needs of the financial sector. In an industry where comprehending and catering to clients’ needs takes precedence, FSC is a robust solution crafted explicitly for this paramount purpose.

The Fundamental Shift Enabled by FSC

Holistic Customer Insight: FSC is a comprehensive repository collating real-time data concerning customer behaviour, preferences, and financial aspirations. This all-encompassing perspective equips financial institutions with profound insights into their clients’ requirements.

Operational Efficiency through Automation: FSC streamlines operations by automating routine tasks and leveraging intelligent technology. This automated framework empowers advisors and agents to concentrate on delivering personalised and invaluable assistance to their clients.

Stringent Compliance Measures: Compliance and data security are pivotal in the financial sector. FSC’s integrated features ensure strict adherence to regulatory frameworks, incorporating robust measures to safeguard sensitive data.

Impacting Financial Sectors

Enhanced Banking Experience: FSC enhances the banking journey by centralising real-time customer data. This streamlined approach expedites processes such as loan approvals and cultivates personalised services, resulting in amplified customer satisfaction and loyalty.

Empowering Insurance Agencies: FSC empowers insurance agents with real-time insights and automation, accelerating onboarding procedures and claims processing. This swift and efficient approach translates into elevated customer contentment.

Optimising Wealth Management: Wealth managers leverage FSC’s comprehensive view of client portfolios to drive productivity, tailor investment strategies, and ensure compliance with regulations.

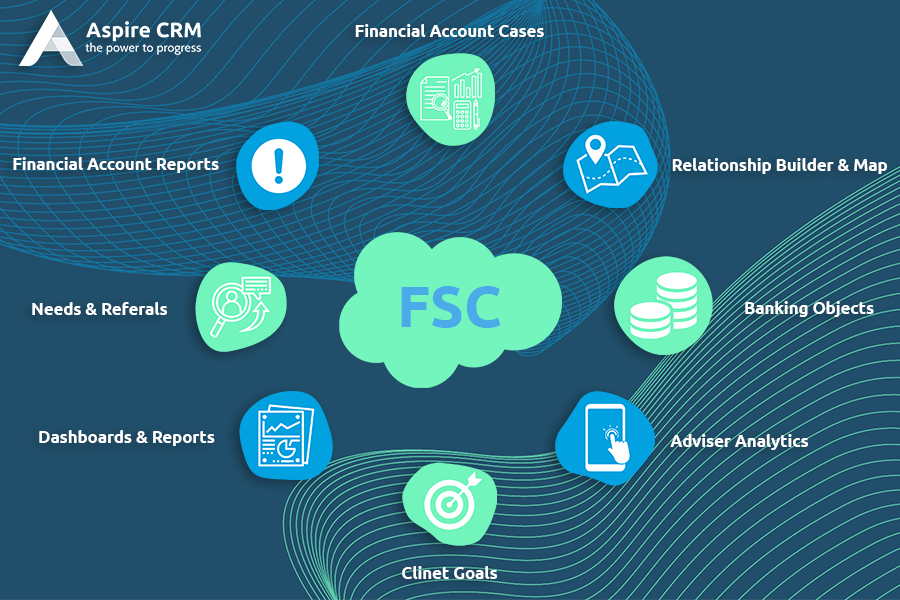

Key Benefits of Salesforce FSC

- Centralised Financial Data: Consolidate all client financial information into one unified system, eliminating silos.

- Relationship-Centric Focus: Empower advisors to prioritize building connections rather than chasing scattered data.

- Real-Time Data Accessibility: Agents and Brokers gain access to the latest, updated information for efficient decision-making.

- Mobile Data Accessibility: Securely access and manage data on mobile devices, ensuring easy control over security measures.

- Client Relationship Visualisation: Bring customer networks to life with comprehensive context, aiding advisors in understanding client needs.

- Effortless Team Collaboration: Simplify collaboration among team members for streamlined workflows and improved productivity.

Aspire CRM’s Role in FSC Adoption

Aspire CRM specialises in guiding financial institutions through the intricate process of integrating FSC. Our tailored approach ensures seamless integration, focusing on aligning the platform with specific institution objectives.

Beyond implementation, our commitment extends to offering comprehensive training and ongoing support. We empower financial institutions to harness FSC’s full potential, fostering a culture of innovation and efficiency.

In conclusion, as an exemplary financial management software, Salesforce Financial Services Cloud redefines CRM in the financial sector, revolutionising how institutions understand customers, operate effectively and adhere to regulations. As financial institutions embrace FSC, they transform their customer relationships and spearhead innovation and excellence in the financial services arena.

Are you looking to harness the power of Salesforce Financial Services Cloud for your institution? Connect with Aspire CRM today! Our specialised expertise ensures seamless integration and optimal utilisation. Empower your financial services with our dedicated support and tailored solutions.