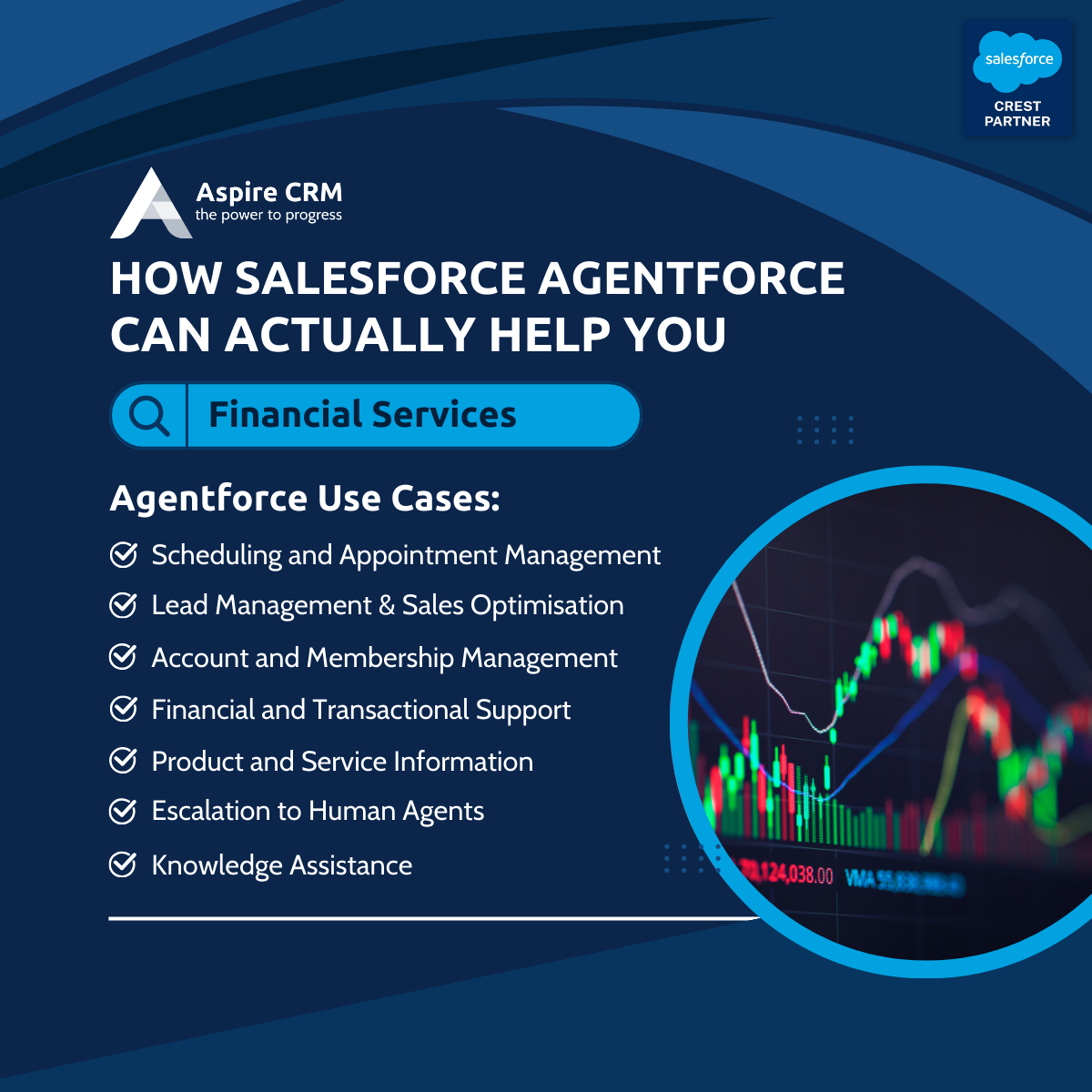

You’ve heard all about Salesforce Agentforce—but how does it actually work in real-world financial scenarios? In the financial sector, customer expectations are evolving and institutions must leverage technology to remain competitive. Agentforce AI offers a suite of autonomous solutions that enhance customer experience, streamline operations and improve fraud prevention. Below, we explore AI in finance examples using Salesforce Agentforce capabilities and how they can benefit the financial sector.

Enhancing Financial and Transactional Support

One of the most critical aspects of financial services is transaction management. Customers frequently seek support for billing, payment issues, loan applications and fraud-related concerns.

With Billing and Payment Support, Agentforce AI can assist customers with enquiries related to invoices, late fees and payment status without requiring human intervention. This reduces wait times and improves overall service efficiency. Similarly, Loan and Credit Services automate responses about loan eligibility, interest rates and repayment options, helping customers make informed financial decisions quickly.

Another major concern for financial institutions is fraud detection and resolution. Transaction Disputes and Fraud Management features allow AI to identify and alert customers about unusual transactions while guiding them through the dispute resolution process. This significantly reduces manual processing time and ensures compliance with security protocols.

Optimising Order and Delivery Management

While order and delivery management is typically associated with e-commerce, financial institutions also handle deliveries of important documents, credit cards, and chequebooks. Order Status and Tracking allow customers to check the real-time status of their financial products, eliminating unnecessary inquiries to customer service.

In cases of misplaced or delayed deliveries, Delivery Management ensures that customers receive timely updates and resolutions. Returns, Exchanges, and Refunds automation can also be beneficial for financial services, particularly when handling unauthorised transactions or refunds for cancelled products such as insurance policies or investment subscriptions.

Providing Accurate Product and Service Information

Customers rely on financial institutions for transparent and reliable product details. With Agentforce AI, banks and fintech companies can automate responses to inquiries about loan terms, interest rates, and investment opportunities.

Product Availability and Specifications ensure that customers get up-to-date information on credit card features, mortgage rates, and investment plans. Meanwhile, Pricing and Promotions capabilities proactively inform customers about limited-time offers, discounts, and fee waivers, helping drive conversions. AI-driven Recommendations further enhance the customer journey by suggesting financial products tailored to individual needs and goals.

Streamlining Account and Membership Management

Account-related issues are among the most frequent customer support queries in financial services. Agentforce AI can efficiently manage tasks such as Membership Enquiries, helping customers understand pricing, benefits, and renewal processes for premium banking memberships.

Additionally, Account Settings and Updates allow customers to modify their account details, update security settings, and reset passwords with ease. AI can also assist with Account Access Issues, handling login problems, two-factor authentication, and security verifications, thereby reducing the workload on human agents.

Automating Scheduling and Appointment Management

Financial institutions often require customers to schedule meetings with advisors, loan officers, or support representatives. Our next AI in finance examples is AI-driven Sales Meeting scheduling automates the process, ensuring that clients can easily book consultations for mortgage discussions, investment planning, or loan applications.

For financial institutions offering maintenance-related services, such as tax advisory or credit score evaluations, Service and Maintenance Scheduling simplifies appointment management and ensures customers receive timely reminders.

Improving Knowledge Assistance

Providing customers with quick and accurate information is crucial in financial services. Automated Responses reduce wait times by instantly answering frequently asked questions related to banking policies, loan terms, and security concerns.

Agentforce AI also enhances Knowledge Management by giving customers and support representatives easy access to educational articles, FAQs, and compliance guidelines. Additionally, AI-powered Content Creation can generate personalised financial advice and marketing campaigns based on customer interactions, improving engagement and customer satisfaction.

Efficient Escalation to Human Agents

While automation can handle many queries, some cases require human intervention. Agentforce AI’s Escalation Management ensures that high-priority cases, such as fraud investigations or complex loan disputes, are seamlessly transferred to human agents.

Sentiment Analysis further enhances customer service by detecting frustration in interactions and prioritising urgent cases. Safety Enquiries features also help financial institutions manage lost/stolen credit card reports, identity theft concerns, and emergency account freezes efficiently.

Driving Sales and Lead Management

AI-driven insights can boost financial product sales by identifying and qualifying leads. Lead Management & Qualification helps financial institutions prioritise potential clients based on creditworthiness, income levels, and spending behaviour.

AI-powered Sales Upselling capabilities also suggest suitable financial products such as investment plans, credit line increases, or mortgage refinancing based on customer activity. Additionally, Application Support streamlines enrolment and application processes for loans, insurance policies, and investment accounts.

Conclusion

Our AI in finance examples have highlighted how Agentforce is revolutionising the financial sector. By automating customer service, improving fraud detection and enhancing transactional efficiency, financial institutions can improve their operational efficiency while delivering a seamless and satisfying customer experience. In an industry where time-sensitive transactions and security are paramount, leveraging AI-driven solutions ensures that financial services remain responsive, secure, and customer-focused.